Insurance is a way to protect yourself and your property from uncertainties and financial loss. People generally insure their houses, cars, businesses, and lives. This is because they’re not sure of what will happen in the near or far future, so they need a safety net.

Although most people know quite a lot about insurance, they often limit that knowledge to buildings, cars, and other property. In fact, many never think about insuring their income. If you want to know more, here are a few reasons why you need income protection insurance.

1. It provides health security.

Anyone can get ill at any time. It could be due to an accident or something else. Besides the unpleasant short term effects, sickness could equally cause you to lose your job. You’ll then wonder where your next meal or income will come from. Additionally, taking care of your hospital bills then becomes another challenge. That’s why you need to ensure your income when you still have the ability.

Cancer patients, for example, can register with Regional Cancer Care Associates (RCCA) for insurance and cancer care telemedicine. They ensure that people with cancer have access to high-quality cancer treatment. Furthermore, they operate at about 31 locations including Connecticut, Maryland, and New Jersey. Anyone in these areas can easily walk in with or without an appointment.

Still, for those unable to go to the doctor’s office due to the COVID-19 pandemic or living in a remote location, there’s the option of telemedicine/telehealth. For instance, telemedicine in the field of oncology ensures that you can attend a consultation, have the doctor diagnose you, undergo medical exams, and receive treatment using telecommunication technologies.

2. It helps you maintain your quality of living.

We all have a certain standard of living that we’re used to. Can we sustain it if we lose our jobs, retire, or get ill and can’t work? Your paycheck won’t come in during any one of these situations and neither will your monthly benefits. That’s why you need the right income protection insurance.

However, there are so many insurance policies and providers around that choosing one may be hectic. If you ever need help finding one that best suits your needs, you can consult an insurance comparison site like iSelect.

Although iSelect is not an insurance provider, they help you with the most important part: comparing prices and choosing the best policy. They also save you time and money, as they’re swift when gathering all your options. Another good thing is that you owe them no obligations. They only help you find the life broker you need, and it ends there.

3. It helps you service your debts.

Getting injured or sick and being unable to work will stop the flow of your income. Having to survive and simultaneously pay off your debtors may be challenging. You may have a loan to service or a mortgage to pay while taking care of your family. Your insurers will help and advise you on how best to go about this. Furthermore, your insurance policy will help pay these debts as you recover from your short term disability or sickness.

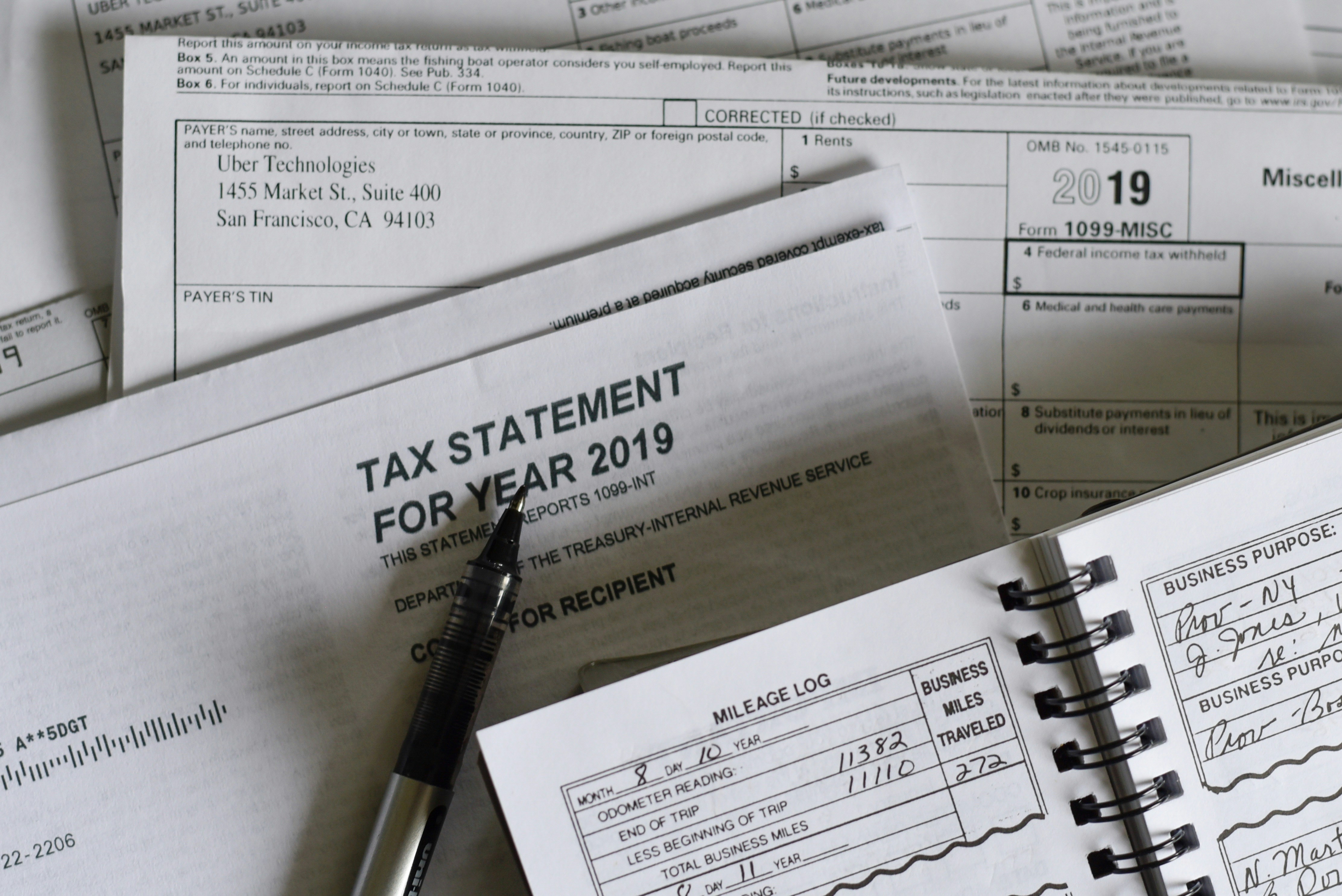

4. You get pretty good tax benefits.

Taking care of your finances includes ensuring you pay income taxes on your salary. Practically no one enjoys paying taxes on their income, as it takes away a considerable chunk of money. Many people don’t see the need to have income insurance, but the reasons to get it are many.

The good thing about income insurance policies is that you may be able to claim income insurance protection on yearly deductions and taxes paid. The amount you can claim is dependent on your marginal tax rate and your taxable income. However, you need to note that you can claim only on taxes paid during the financial year.

5. It allows you to focus on your recovery.

Getting sick is stressful enough. Adding all the burdens of your pay and income makes it more challenging. It’ll strain you and drain you, as money is the most significant source of stress. It may also cause your health status to deteriorate even faster. Income protection insurance gives you the peace of mind to focus on your recovery, so you can get back to work quicker or start feeling better altogether.